First Off

Payment systems are used daily by Canadian households and businesses to send millions of transactions totaling billions of dollars. To guarantee that it will continue to satisfy Canadians’ demands in the digital economy, the country has been updating its payment infrastructure in recent years (Miller and Olivares 2020). The electronic system that transfers significant amounts of money between financial institutions is one aspect of this modernization. Payments Canada, which operates Canada’s key payment systems, is spearheading this endeavour in coordination with financial institutions and regulatory bodies.

When Payments Canada introduced the new Lynx system on August 30, 2021, it accomplished a significant milestone. Large Value Transfer System (LVTS), which was Canada’s high-value payment system for over 20 years, is replaced by Lynx. Following its launch, Lynx was deemed a systemically important payment system by the Bank of Canada, placing it within its purview (Bank of Canada 2021).

The real-time gross settlement (RTGS) approach is utilised by Lynx and is currently the industry standard for wholesale payments worldwide (Bech, Shimizu, and Wong 2017). The old LVTS, in comparison, paid the net sums owed between participants at the conclusion of the day after accruing its payment activity during the course of the business day. In the end, the system was supported by a settlement guarantee from the Bank of Canada, and this led to intraday credit exposures amongst the participants that were controlled by LVTS risk controls (Arjani and McVanel 2006).

There is no credit risk amongst participants in an RTGS system. Payments are settled in real time through a standard RTGS system as well, although participants must supply additional liquidity. This is the conventional trade-off between settlement speed, liquidity efficiency, and credit risk.

Nevertheless, Lynx is furnished with additional instruments that aid in reducing the liquidity requirements of financial establishments, while avoiding notable setbacks (Kosse, Lu, and Xerri 2020; Bank of Canada and Payments Canada 2022).

Assume that two financial organisations are in need of sending a sizable payment to each other. Without offering liquidity, both institutions can add their payments to a queue. Lynx algorithms search for payment activity that is queued up and can be offset. Although there is a slight delay in payment settlement, locating these offsets reduces participants’ liquidity requirements.

What alterations have the Lynx switch made to Canada’s wholesale payment practises? What impact does it have on Canada’s wholesale payment system’s effectiveness? A new analysis by Desai et al. (2023) using 6 million settlement transactions filed in the six months beginning in October 2021 offers a quantitative assessment of these problems.1. The settlement data from the legacy LVTS for the same six-month period the year prior is contrasted with these observations.

Three important conclusions are drawn from the examination of the settlement data from LVTS and Lynx. In contrast to the LVTS:

Although Lynx managed higher overall money volumes, seasonal patterns remained largely unchanged.

The majority of the daily payment amount was transmitted through Lynx earlier, and the queue only slightly delayed settlement.

Higher liquidity efficiency in payment settlement was attained by Lynx.

Let’s investigate each of these discoveries.

First important finding: Payment flow

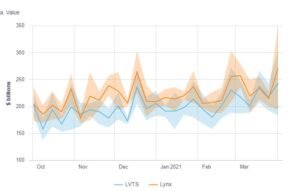

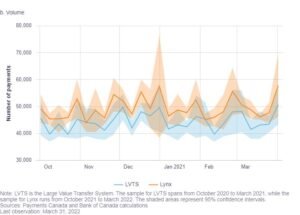

We discover that Lynx settled more payments in terms of both volume and dollar amount during the two study periods compared to the LVTS. The value and volume of Lynx increased by roughly 10.5% year, as seen in Chart 1. We don’t think that this system modification will have a big effect on payment flows by itself. Rather, outside patterns in payment activities are probably to blame for this development.2. In the end, both systems’ typical seasonal trends in weekly values and volumes held true.

Chart 1: The flow of payments through Lynx was higher than in the LVTS

System-level daily average values and volumes of payments settled in LVTS and Lynx, weekly average

Key finding 2: Timing of payments

Bank staff examine the proportions of total daily payment value sent to the two systems by a certain time of day. During the two six-month periods, the bulk of the payment value arrived earlier in Lynx than in the LVTS (Chart 2). This earlier timing was likely because Lynx’s design encourages financial institutions to send payments earlier in the day to increase the chance of finding liquidity efficiencies. Payments that were not in the queue in Lynx were settled in real time, while payments in the queue faced a relatively minor average delay in settlement of 27 minutes.

Key finding 3: Liquidity efficiency

An important measure of payment system performance is the liquidity efficiency ratio (LER), which is the value of payments settled for every dollar of liquidity used. A higher LER means more liquidity efficiency in the payment system. During the two periods studied, the LER of Lynx was higher than that of the LVTS (Chart 3). This improvement in liquidity efficiency can be attributed to the liquidity saving mechanisms in Lynx and their wide adoption by participants (see Rivadeneyra and Zhang 2022; Garratt, Lu and Tian 2023). In addition, the design of Lynx allows participants to centralize all liquidity and payments in the same place, unlike the LVTS, which separated them into two tranches.

In summary

For the swift and secure transfer of large amounts across Canadian financial institutions, Lynx is an essential system. Since its inception, Lynx has seemed to successfully balance the risks associated with credit risk, quick settlement, and efficient liquidity.

Though an RTGS system settles payments in real time and eliminates credit risk between participants, a recurring problem with these systems historically has been their increased liquidity requirements. The findings indicate that Lynx processes payments in the queue rapidly while utilising liquidity effectively. The successful switch from the LVTS to Lynx may be attributed to the system’s sound design and the close cooperation between Payments Canada, financial institutions, and authorities.